Health care is complicated. Shopping for an individual health plan just got even more so, with President Donald Trump’s decision last month to block $7 billion in Affordable Care Act subsidies.

Known as cost-sharing reduction payments (CSRs), these federal funds had helped insurers offset the costs of the discounts they are required to offer to some lower-earning customers to help them pay for deductibles and copays.

We’ll spare you the details. But because of how state regulators responded to the chaos and how insurers are trying to recover the money through higher premiums, common-sense rules of shopping may no longer apply.

A high-coverage “gold” plan in many states might now be cheaper than a medium-coverage “silver” plan. The reported 15 or 20 percent premium spikes resulting from Trump’s move might nail you right in the wallet. Or, weirdly, it could save you hundreds of dollars next year if you play your cards right.

Experts’ advice, in brief, is: SHOP AROUND. Play with different options on healthcare.gov or state marketplaces. Don’t just renew this year’s plan. More than ever, for 2018 that might not be the best deal.

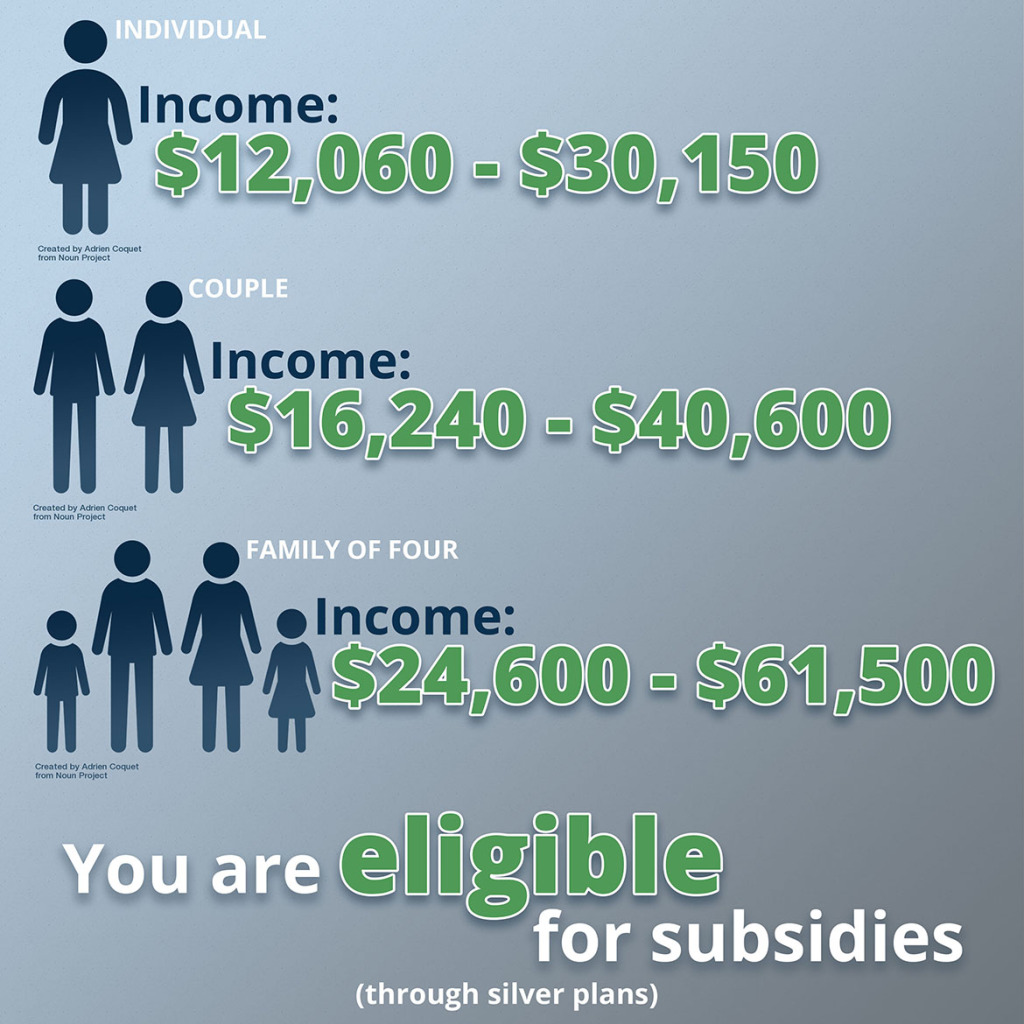

Find your situation here:

Household income is between $12,060 and $30,150 for an individual, $16,240 and $40,600 for a couple and $24,600 and $61,500 for a family of four.

By law, insurers still must pass along the cost-sharing reductions, even though Trump cut off the reimbursement. And you are probably eligible for them.

But to qualify for the cost-sharing reductions, which lower deductibles and copays when you seek care, you must purchase a silver plan on the marketplace. People buying the other metal levels — the more comprehensive gold or platinum plans or less generous “bronze” plan — cannot get this benefit. So unless you hardly ever see a doctor, get a silver plan.

However, if you’re healthy and at the lower end of these income ranges, a bronze plan might make the most sense.

That’s because of the other Obamacare subsidy, which reduces premiums.

These subsidies are paid directly to qualifying consumers in the form of tax credits. The premium subsidy is so generous for 2018 (we explain why, below) that, for many people, they could cover the entire cost of bronze plans.

Cost-sharing reductions help only if you expect to pay out-of-pocket costs for docs and hospitals. If you don’t — and if you feel like gambling that you won’t need expensive care — a free or super-cheap bronze plan might be better.

At the lower ranges of this income group, you might be eligible instead for Medicaid — in states that expanded that program under the ACA. This online subsidy calculator can help you figure it out.

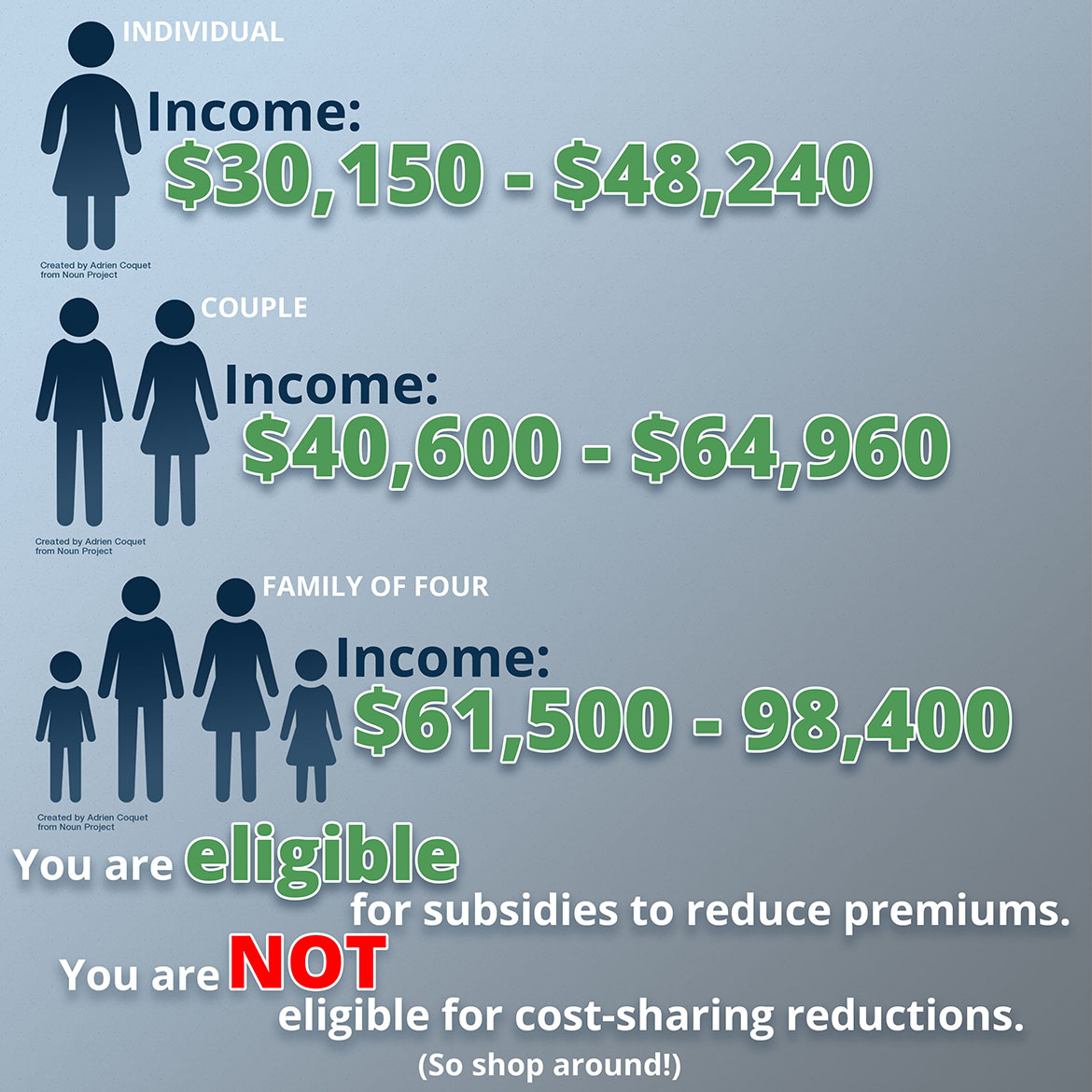

Household income is between $30,150 and $48,240 for individuals, $40,600 and $64,960 for a couple and $61,500 and $98,400 for a family of four.

You’re eligible for subsidies to reduce premiums but not the cost-sharing reductions. Even so, Trump’s decision to cut them may affect you — in a good way.

To recover the missing $7 billion, most insurers are jacking premiums for silver plans — an estimated 20 percent extra.

The good news is that higher premiums don’t hurt most marketplace consumers. Obamacare caps how much eligible consumers are expected to pay for health insurance — even if premiums go to the moon. The federal premium subsidies cover the difference.

But that’s not all. Trump’s move makes the premium subsidy more generous. Here’s how.

The level of premium subsidy you receive is based not just on your income but also on silver-plan prices, and now silver premiums are going up a lot. The higher the silver premiums, the more generous the subsidies. But that subsidy is not limited to use on a silver plan.

Anybody eligible can take those subsidies and shop for any kind of plan on the marketplace. That’s why in Texas, Pennsylvania, Michigan and other states a high-benefit gold plan might be less expensive next year or not much more than a silver plan. It’s why many consumers could see their premium bills fall in 2018 — in some cases, to zero.

To repeat: Shop around. Shop early. The plan you have now probably won’t be cheapest next year.

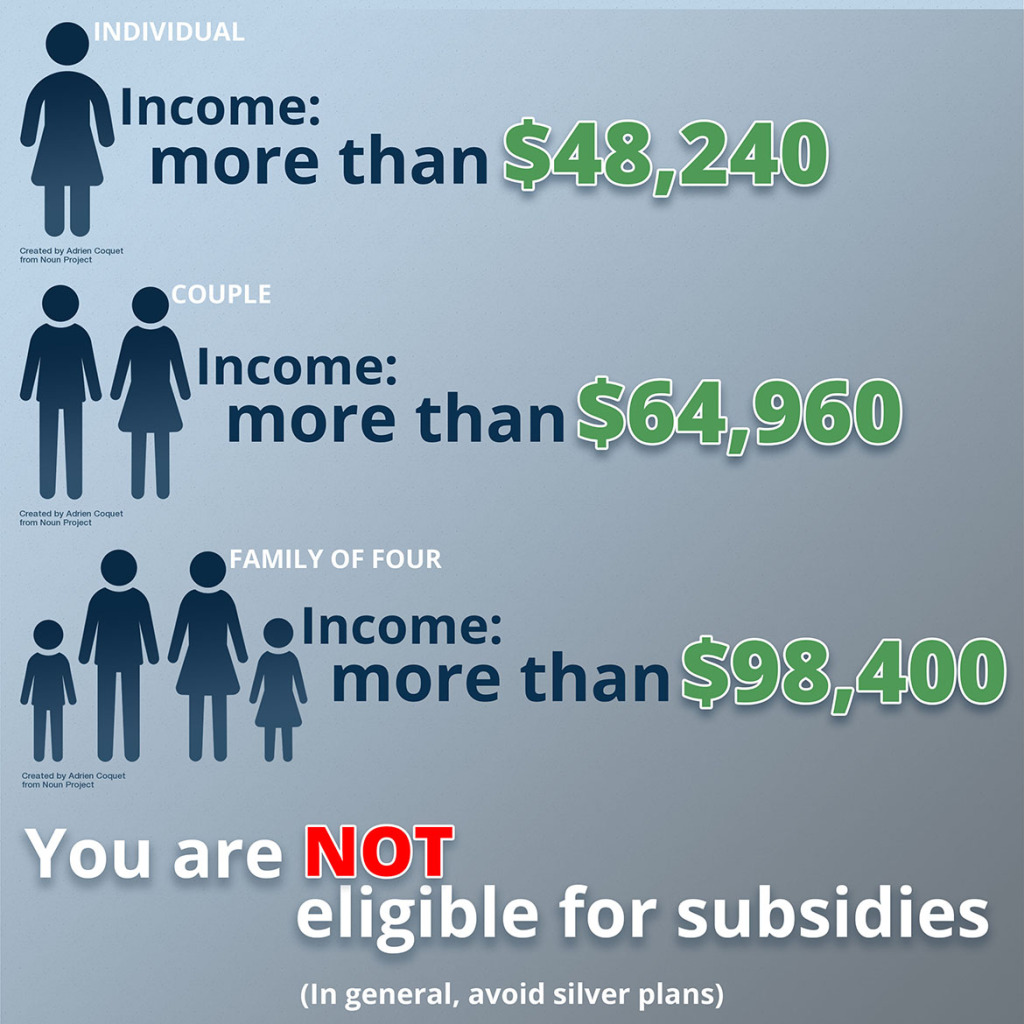

Household income is more than $48,240 for individuals, $64,960 for a couple and $98,400 for a family of four.

More than 7 million of these folks buy individual health insurance plans through or outside the ACA’s online marketplaces.

If this is you, you’re ineligible for any Obamacare subsidies. That means your chances of getting slammed by premium increases for 2018 are high. Silver-plan premiums are soaring by 35 percent or more because of high claims and Trump’s decision to stop cost-sharing reimbursement to insurers.

But there are ways to limit the pain. Generally avoid silver plans and look at bronze and gold. Those premiums are probably rising less.

However, California and about a dozen other states allowed insurers to sell a separate class of silver plans without the cost-sharing money built into premiums. These may be available only outside the official, online ACA marketplaces, so to find them you have to ask a broker or check websites of insurers or online brokers such as eHealth or GetInsured.

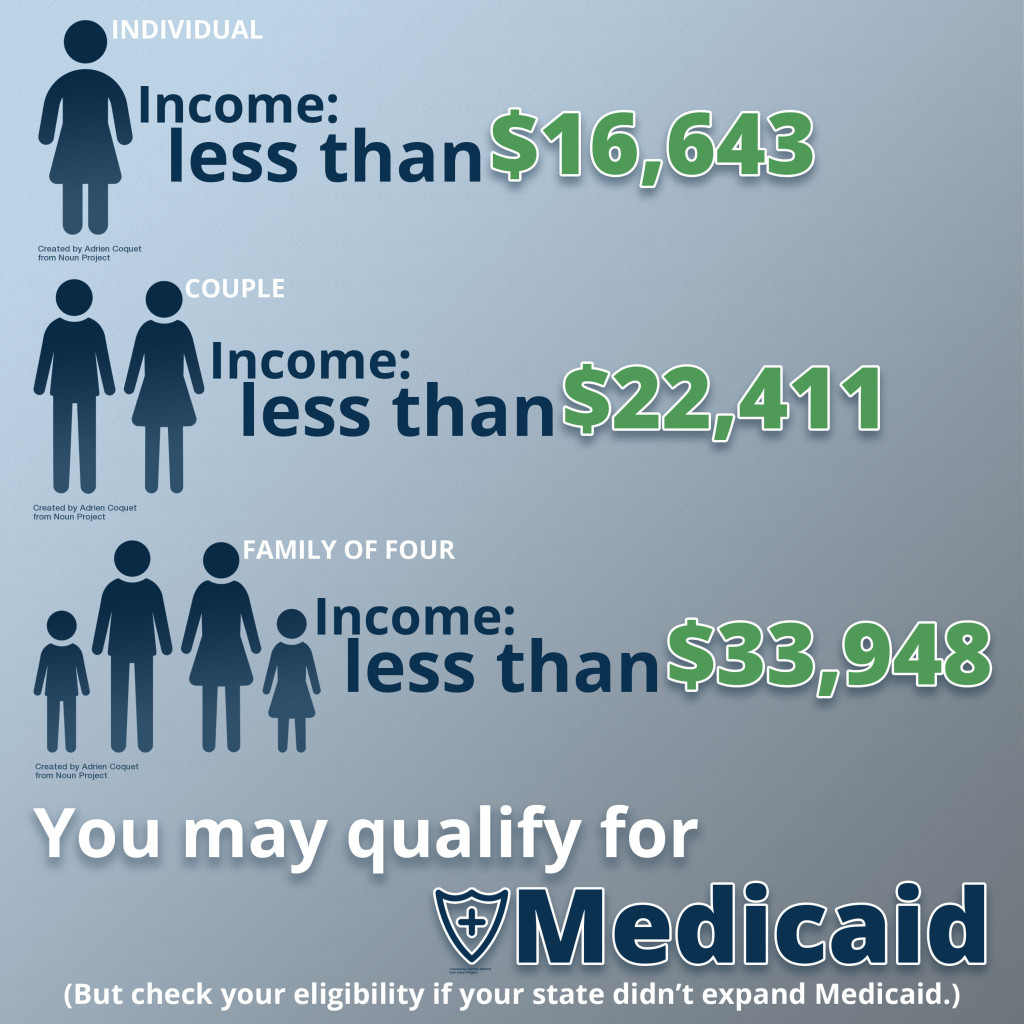

Household income is less than $16,643 for an individual, $22,411 for a couple and $33,948 for a family of four.

You may qualify for Medicaid, the federal and state health program for low-income people. However, 19 states, mostly in the South, did not expand the program under the health law.

Medicaid eligibility in those places is much narrower, especially for adults, than in the rest of the country. That accounts for many of the 28 million uninsured Americans.

The subsidy calculator shows whether your income makes you eligible for Medicaid and whether your state has expanded Medicaid.

This article was reprinted from kaiserhealthnews.org with permission from the Henry J. Kaiser Family Foundation. Kaiser Health News, an editorially independent news service, is a program of the Kaiser Family Foundation, a nonpartisan health care policy research organization unaffiliated with Kaiser Permanente.