If you are black and have ever purchased an automobile, you likely may have walked away from the experience feeling as though you were not given the best deal possible or that the salesperson was less than forthcoming about the vehicle’s financing. That feeling was not a figment of your imagination, but likely the reality of your experience according to a new report. The National Fair Housing Alliance (NFHA) has released Discrimination When Buying a Car: How the Color of Your Skin Can Affect Your Car-Shopping Experience.

The National Fair Housing Alliance notes that auto-loans are the third most-likely form of debt for U.S. consumers, following home and student loans, and over three-fourths of new cars purchased are done so through an auto loan. However, the report indicates there is widespread discrimination in the auto loan industry, claiming “This discrimination has undoubtedly played a part in creating the racial and ethnic wealth gaps and credit access disparities that exist in the U.S. today, and it will ensure that they persist if allowed to continue unchecked.”

While it may seem unusual for a housing advocacy organization to focus on the car-buying experience, the NFHA makes the point that transportation is directly tied to access to housing and employment, and discrimination in the car-buying market exacerbates inequality in these other areas. If public transportation is lacking, and it often is in communities with large numbers of residents of color and low-income residents, the only viable alternative is to purchase an automobile to provide access to work and other important destinations.

It is not a new consideration as researchers in the past have detailed the degree to which black consumers are subjected to terms that are worse than white consumers who possess the same or worse credit worthiness. The report cites research by Yale Law Professor Ian Ayres from 1991 that identified racial disparities in the sales prices offered at a new car dealership in Chicago. Ayres revisited the data in 1994 and used a new quantitative method of identifying the causes of discrimination to account for weakness in the original methodology from three years prior. The results were the same. Another study from 2003 conducted by Vanderbilt Business Professor Mark A. Cohen examined 1.5 million General Motors Acceptance Corporation (GMAC) loans made between 1999 and 2003. He found that Black consumers were three times more likely than equally qualified whites to be charged an interest rate markup on GMAC financed loans.

The report breaks down the components of car financing and details how black consumers are frequently led into unfavorable terms by salespersons, denied access to credit information and how all consumers are generally pressured into a same-day purchase and not given sufficient information to comparison shop. The two aspects of the annual percentage rate or APR, the consumer’s cost to secure a loan, are the “buy rate” and the “dealer reserve.” The buy rate is based entirely on credit and risk factors and is generated for car dealers by the lending institutions. The rate is determined by the consumer’s financial information; income, debt, monthly rent payments and current credit score. It is the minimum interest rate offered by the lending institution. The second part of the APR is the dealer reserve or “markup.” This is determined at the discretion of the car dealership and is not based on the consumer’s financial information or risk of loan default. It is this discretion that often traps black consumers in auto loans with less than favorable terms.

What it means in real terms is that black consumers pay more in terms of higher interest, and sometimes fees, over the life of an auto loan for the purchase of a vehicle. This can amount to thousands of dollars for black consumers who should be offered more favorable terms based on their credit score, credit history, employment and income.

Though there are laws in place to enforce fair access to credit, they have their limitations. Under the Truth-in-Lending-Act (TILA), car dealerships are required to disclose the annual percentage rate (APR), finance charges, amount financed, the total number of payments and other terms theoretically before the consummation of a credit transaction. In practice, the disclosures tend to be made in the sales contract, at a point when the consumer is likely purchasing the vehicle and unable to use the information to comparison shop. The Equal Credit Opportunity Act (ECOA) prohibits creditors from discriminating against a credit applicant on the basis of race, color, religion, national origin, sex, marital status, age, or because an applicant is a public benefits recipient. These protections are supposed to kick-in when a consumer makes a request for credit. Like many well-intentioned laws, the enforcement can be lacking, as well as the coordination between federal and state authorities that should be protecting the interests of consumers.

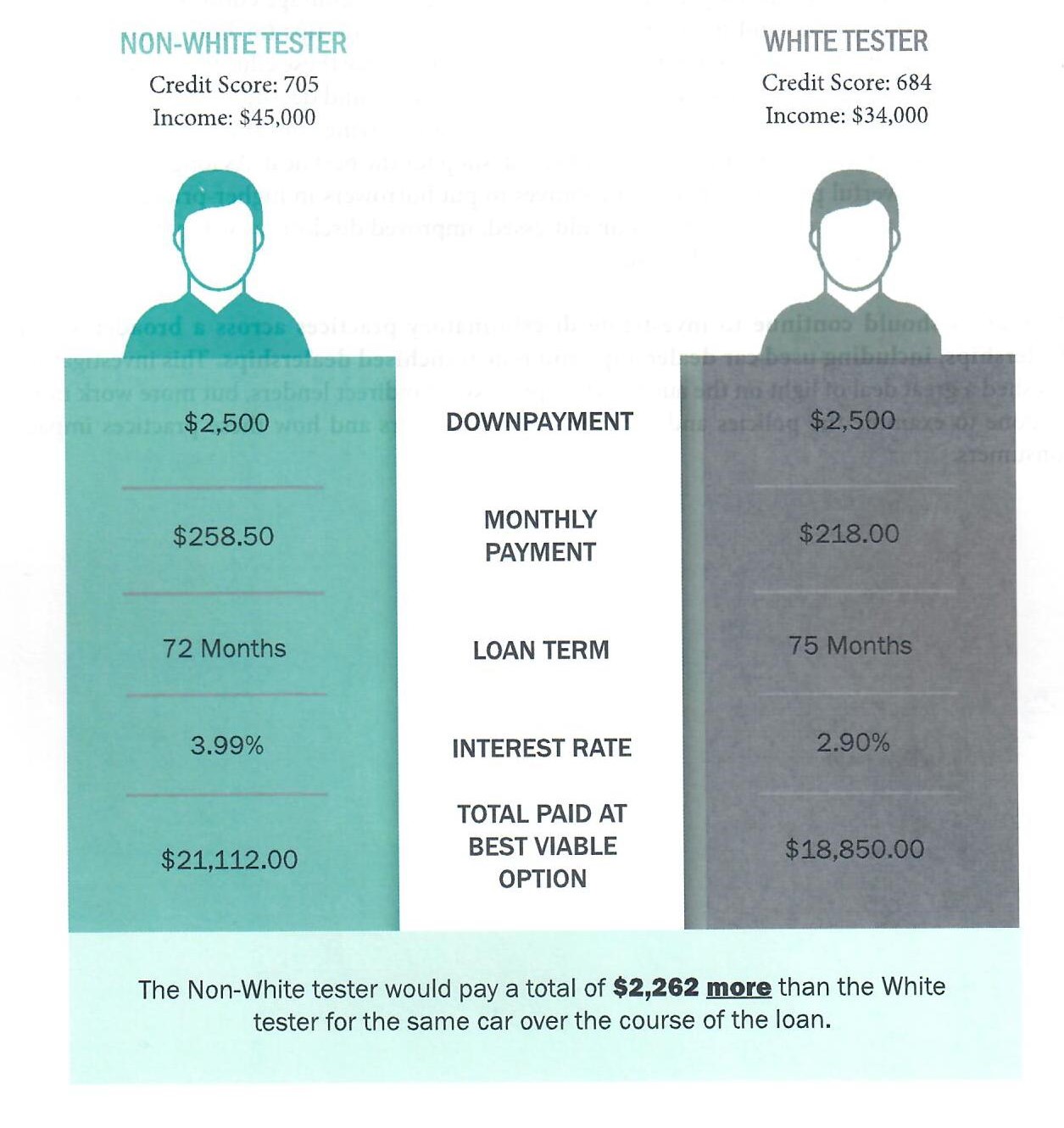

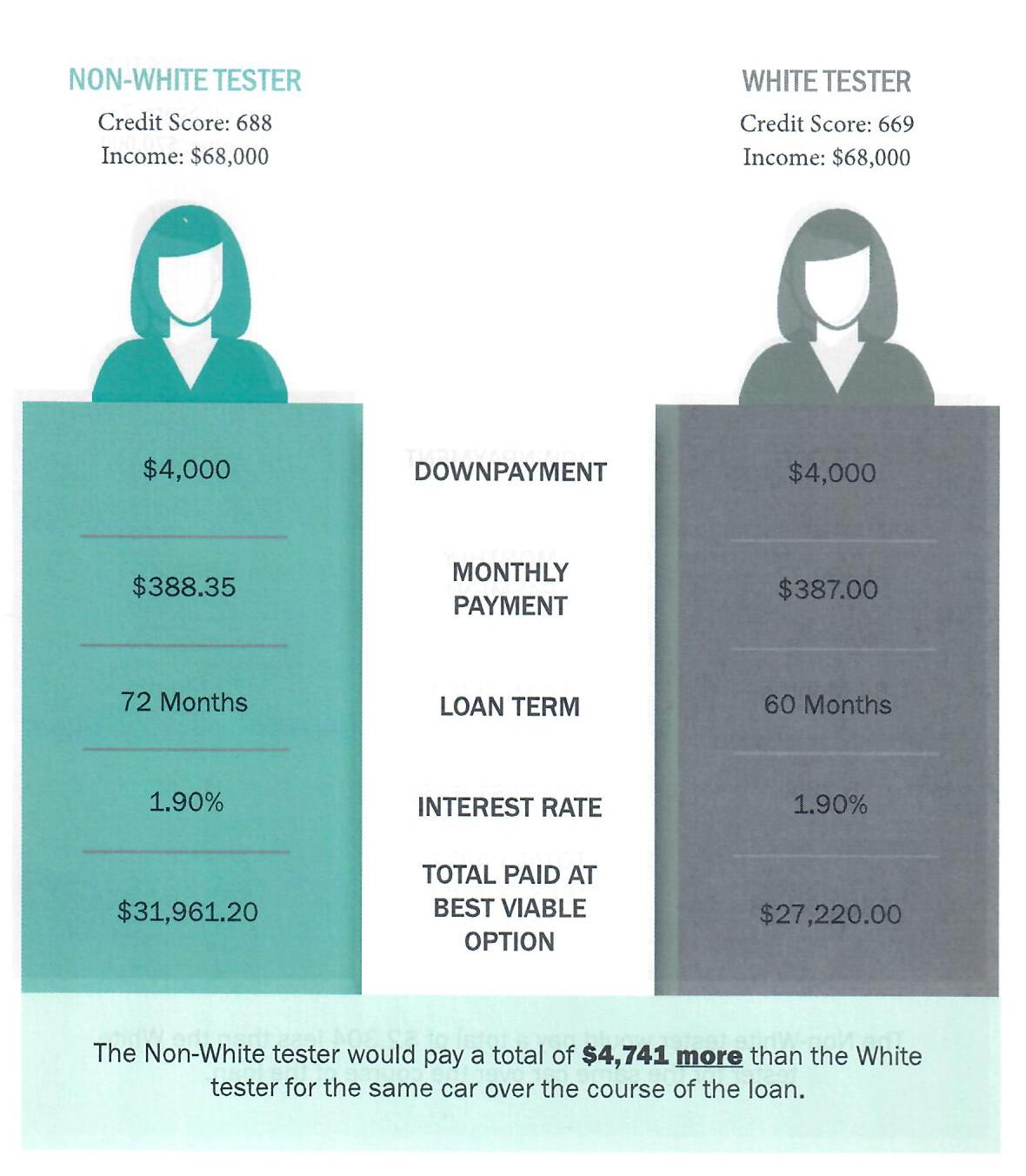

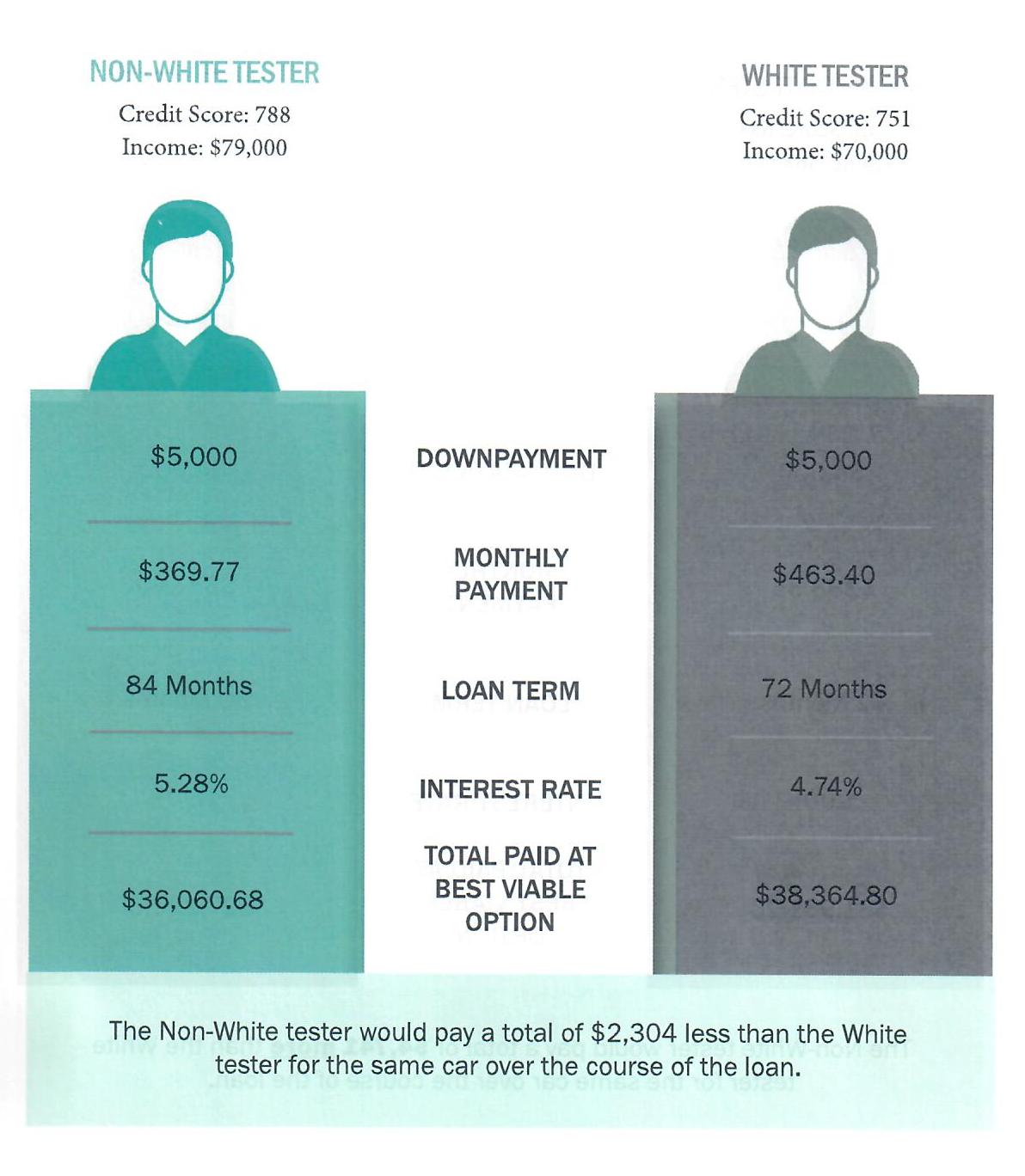

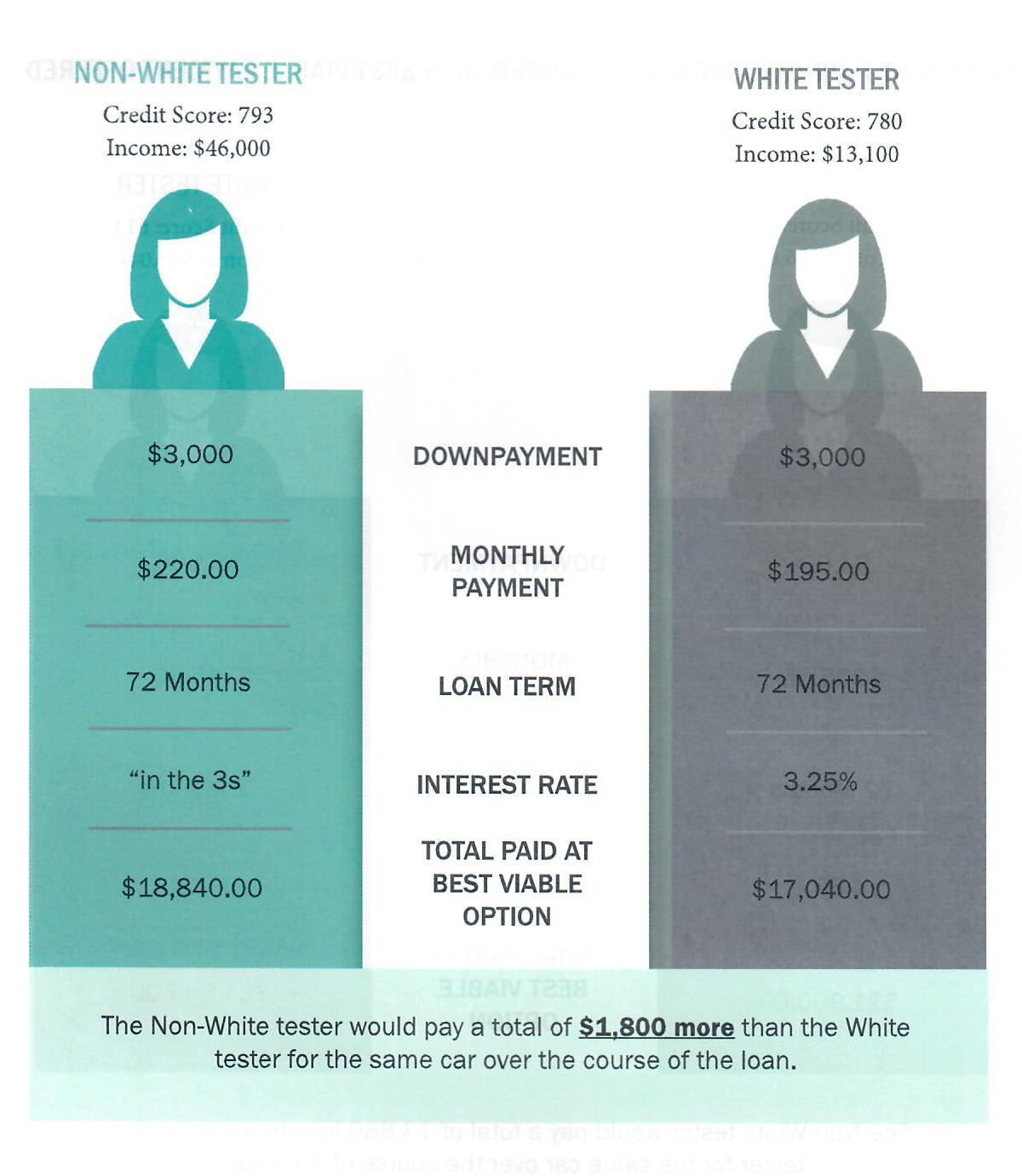

The NFHA used non-white and white ‘testers,’ individuals who portrayed consumers seeking to purchase a new car. The testers were trained and practiced their roles before they ventured into showrooms. They had specific credit and income profiles, and had hidden audio recorders to capture the conversation with salespersons. Testers were paired non-white/white and separately sought to purchase the same vehicle to test what type of terms would be offered each by the salesperson.

The diagrams below demonstrate the result of the testers visits to car dealerships and the differences in outcomes between non-white and white testers.

Key highlights in the report include:

• 62.5 percent of the time, the non-white testers who were more qualified than their white counterparts received more costly financing options

• Non-white testers who experienced discrimination, on average, would have paid $2,662.56 more over the life of the loan than less-qualified white testers

• 75 percent of the time, white testers were offered more financing options than non-white testers

• Salespersons were more helpful to white testers, offering help to bring down interest rates and car prices using incentives and rebates, or by making phone calls to secure better financing

There are several recommendations in the report to counter these patterns of unfair and discriminatory lending practices in the auto-loan industry. First, it is suggested that State Attorneys General actively enforce state anti-discrimination and consumer protection laws in the auto lending industry. There is also the recommendation that the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB), an agency that might not survive the Trump administration, address discriminatory practices in the auto lending industry and that the oversight authority of CFPB should be extended to automobile dealers. In addition, the report makes the recommendation that dealer mark-up rates should be prohibited. Strengthening disclosure requirements is also recommended to standardize costs and require dealers to make the Truth-In-Lending-Act disclosures prior to the consumer agreeing to purchase a vehicle. Lastly, the report recommends that regulators investigate discriminatory practices across a broader range of dealerships, including used car dealerships and non-franchised dealerships.

To read the full report click here.

today in black history

July 27, 2023

Audley "Queen Mother" Moore, one of the first activists to demand reparations for slavery, was born in 1898 in New Iberia, Louisiana.

Discrimination in Auto Loans Rampant

POSTED: January 23, 2018, 9:00 am